Everyone seeks to attain financial stability and security throughout their lifetime. These are indeed necessary for daily living and affording the necessities for survival. But at the same time, no one wants to keep “surviving” where you struggle to acquire every need. This, in turn, further emphasizes the need for financial stability.

However, financial stability cannot exist if you lack the required proficiency. In other words, if you lack a proper understanding of how to manage your finances, the results won’t always look good.

Therefore, one can say that financial literacy deals with having a clear understanding of financial skills. It further entails knowledge of how to apply these skills to different spheres of finance, such as budgeting, investing, and saving.

Like every other skill, you must acquire knowledge to improve your financial literacy. So, what books do you need to start reading to get started on your healthy relationship with money?

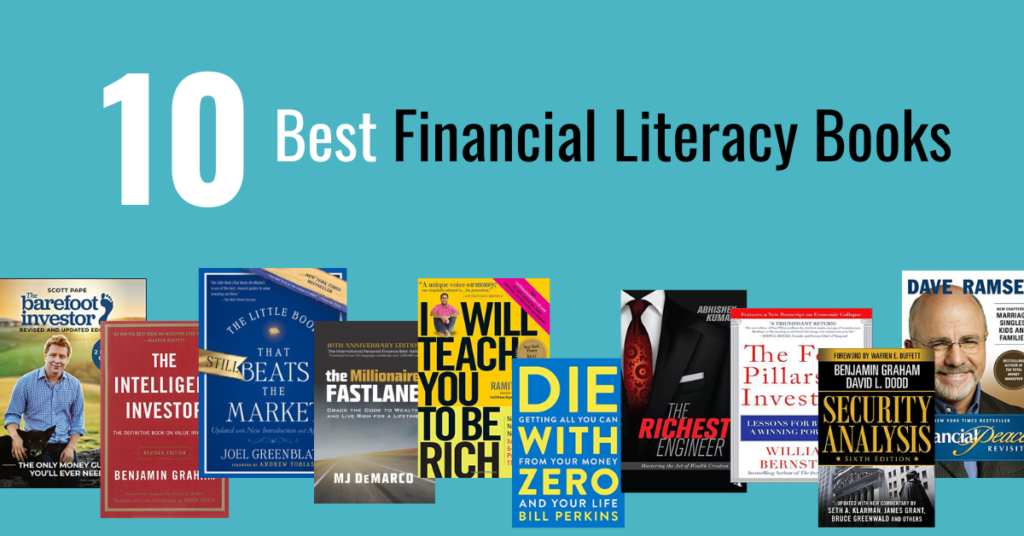

The Barefoot Investor

The Barefoot Investor

Every financial literacy journey begins with a guide to handling money. You see, financial literacy is about more than just knowing all monetary concepts. It also requires you to have a clear understanding of the practical application.

With The Barefoot Investor, folks can now learn to draft financial plans in the simplest ways possible. At the same time, this book gives an insight into how important it is to manage your money while showing you how to do so without groaning for hours a day.

The Intelligent Investor Rev Ed.: The Definitive Book on Value Investing

The Intelligent Investor Rev Ed.: The Definitive Book on Value Investing

Arguably the most significant investor the twentieth century was blessed with, Benjamin Graham, made sure to share his knowledge with the masses. He taught financial enthusiasts far and wide the philosophy of value investing to help them avoid errors and develop fool-proof strategies.

And now, this knowledge can be grasped by you through the modernization of his text into a better edition for all to read. Through this book, you’ll learn how to accurately apply the principles that Graham laid out for all to reach their financial goals.

The Little Book That Still Beats the Market

The Little Book That Still Beats the Market

With over 300,000 copies, Joel Greenblatt has published a text vital to financial literacy that it’s even considered a New York Times Bestseller. Through this book, Joel explains holistically the methods investors can use to outperform the market average.

Those methods all revolve around capturing businesses that scream profit potential while they’re in their infancy. And with a new revised edition, readers can now learn about the data from research on recent financial models. These data help prevent unnecessary errors while improving current financial models.

The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

Here’s a book for the crypto fanboys. This Bestseller tackles the major questions about the different models available for encouraging financial literacy. It aims to speak to the readers directly, making them question their own financial goals and strategies.

If you need an undiluted book to open your eyes to the reality of finances, here’s a good starter pack. Are your strategies worth the time you spend on them? Do you gain anything from any of the financial gurus you follow and the platitudes they speak? Well, there’s only one way to find out.

I Will Teach You To Be Rich

I Will Teach You To Be Rich

The major setback to financial stability is a lack of financial literacy. Everyone’s determined to make it big and reach a state of healthy finances, but how many of them know how to get there? Not a lot. Thankfully for Ramit Sethi, however, these ambitious lads can discover the path to their lofty goals.

Ramit Sethi used the 4 pillars of personal finance (banking, saving, budgeting, and investing) to strike home the various points you need to take home for better financial growth. It’s tailored to young adults and teaches them the practical approach to developing their financial literacy.

Die With Zero: Getting All You Can from Your Money and Your Life

Die With Zero: Getting All You Can from Your Money and Your Life

We’ve seen a lot of sad cases where individuals spent their whole lives chasing financial stability only to pass away without tasting it. The whole journey getting there ends sadly as they fail to taste the fruits of their lifelong labor. In the end, their lives were pretty much wasted.

It’s all down to the common sense we apply in our financial journey. Rather than spend your entire life trying to make funds, you need to understand why a balance is so important. This book is for those who seem to save all their experiences for the distant future and spend the present accumulating wealth.

The Richest Engineer

The Richest Engineer

If there’s any question that has never failed to pop up, it’s the question of how some people seem to make it financially with ease while others continue in their struggles. People want to know the secrets hidden on the path to financial literacy.

There are countless financial principles to follow, but how many do you need? How many propel you to the pinnacle of wealth and stability? How do you discover these principles? How do you smartly accumulate wealth without wasting valuable resources such as time and effort? The answers to these and more lie in a copy of this text.

The Four Pillars of Investing: Lessons for Building a Winning Portfolio

The Four Pillars of Investing: Lessons for Building a Winning Portfolio

A classic text designed to guide you through your financial journey without having to solicit multiple individuals for help. This guide also helps you to build your professional portfolio with the basic principles and minimal effort.

Financial Peace Revisited: New Chapters on Marriage, Singles, Kids and Families

Financial Peace Revisited: New Chapters on Marriage, Singles, Kids and Families

Attaining financial peace is challenging, there are lots of steps to follow and lots of obstacles to overcome. Through the Financial Peace Revisited, learn key aspects of financial literacy such as how to stay out of debt, sound financial decision-making, adapt to the flow of money, and much more.

Learn how financial literacy is key to steady finances, a steady home, and a lifetime of tranquility.

Security Analysis

Security Analysis

by Benjamin Graham, David Dodd

We close this chapter with one of the most influential financial publications. It also takes inspiration from great financial philosophies such as those laid out by David L. Dodd and Benjamin Graham.

Conclusion

Do you have financial goals and ambitions? Do you picture a life of financial peace? Well, the first step to achieving those dreams rests in your level of financial literacy (feel free to read our article about books that will make you rich).

To ensure you’re on the right track, simply head over to BookScouter to purchase one of these books and begin your journey to financial stability.

If you’re the kind of person who relies heavily on your smartphone for various purposes throughout the day, has a vast collection of apps installed on your device, you’ll definitely find it helpful to read our guide on mobile apps to control finances.