Thinking about investing and not sure where to start? One key principle you’ll come across on your journey to independent trading: is technical analysis. This perhaps opaque term has a highly specific definition in the finance world: ‘…a methodology for analyzing and forecasting the direction of prices through the study of past market data’.

It’s a subject rich with its own language and terminology, which can exclude outsiders but can be deciphered, according to the many guides out there, with the right help, the right attitude, and perseverance.

In short, tentative or confident would-be investors need to master universal skills like spotting patterns and paying close attention to history. They’ll also need to chart a steady course through the seemingly random effects of human biases on buying and selling behaviors.

For those of a nerdy or disciplined disposition, those who love a spreadsheet and a touch of scientific rigor, as well as armchair psychologists, as always, there’s a book for that!

As ever, for those afflicted with fiduciary confusion, BookScouter comes to your rescue, with our rundown of five of the best:

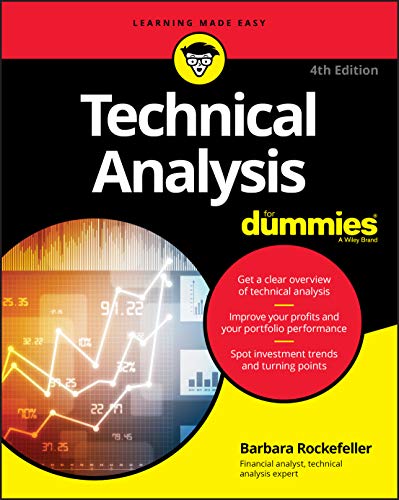

Technical Analysis For Dummies

Technical Analysis For Dummies

Confirming the suspicion that there’s a ‘For Dummies’ guide to almost everything: this one providing a nuts-and-bolts approach highly readable for the layman. Rockefeller takes a friendly approach to her ’… way of looking at securities prices and how they wag and what wags them.’ This For Dummies manual also emphasises the importance of a trader knowing herself, certain essential personality traits, and, crucially, realistic attitudes to risk.

Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications

Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications

A workmanlike, ‘does what it says on the tin’ reference text, this one’s a workhorse of a guide, clocking in at a robust near-600 pages, with the reassuring, authoritative voice of a former technical analyst for CNBC, with forty years of market experience. Murphy’s text breaks down 10-year trends and concepts in an accessible format, with an accompanying study guide for testing theoretical knowledge.

Technical Analysis for Beginners: Take $1k to $10k Using Charting and Stock Trends of the Financial Markets with Zero Trading Experience Required

Technical Analysis for Beginners: Take $1k to $10k Using Charting and Stock Trends of the Financial Markets with Zero Trading Experience Required

Encumbered with an unwieldy title and bold claims, per much of the literature and online content on finance available.

Penn’s work reads rather more like self-help than a study guide, though it does boast ‘a free bonus companion masterclass which includes video analysis of real-life stock examples to expand on some of the key topics discussed’ and real-world applications of the lessons learned. Presented in a more conversational style, it makes a welcome contrast and companion to the more academic texts on technical analysis.

Technical Analysis from A to Z, 2nd Edition

Technical Analysis from A to Z, 2nd Edition

A glossary and primer on essential terms, with definitions, updated for 2022, which aims to introduce the newcomer, while providing handy reminders for experienced traders. It outlines with useful clarity the distinctions between ‘investing’ (a short-term activity) and ‘trading’ (a long-term one). By taking a broad, historically informed view, largely with reference to Dow’s theories, Achelis’ book underlines, as do many texts on this list, the truism: ‘The future can be found in the past’.

Japanese Candlestick Charting Techniques, Second Edition

Japanese Candlestick Charting Techniques, Second Edition

A guide that takes the longest of long views, detailing an ancient form of data analysis using candlestick charts, ‘…so called because the lines resemble candlesticks’ benefits from a historical slant.

Japanese Candlestick Charting also makes for a fascinating insight into the financial mores of an ancient culture alongside differences in Japanese and Western communication styles, as well as modern Keynesian economic thought. Nison enlivens his guide with personal anecdotes and real-life examples from decades’ past.

Trading your way to 6-figures, or just finding your feet? Know your Bollinger bands and MACDs from your oscillation ranges? Let us know in the reactions and socials! And feel free to check the 10 books that will make you rich list.